What does it mean and what is the difference?

To put it simply, the Prime Cost method gives you equal deductions each year for the effective life of the article.

Whereas the Diminishing Value method gives higher deductions in the earlier years.

The majority of investors choose the Diminishing Values method.

The significantly higher deductions in the first five years or so means less tax to pay.

The initial years following the purchase of your investment rental property are usually when you are most cash poor.

Having recently acquired your investment property you have to deal with all the initial associated costs surrounding the purchase, such as stamp duty etc. You may also be undertaking some initial capital improvements such as window furnishings, landscaping, painting and the like.

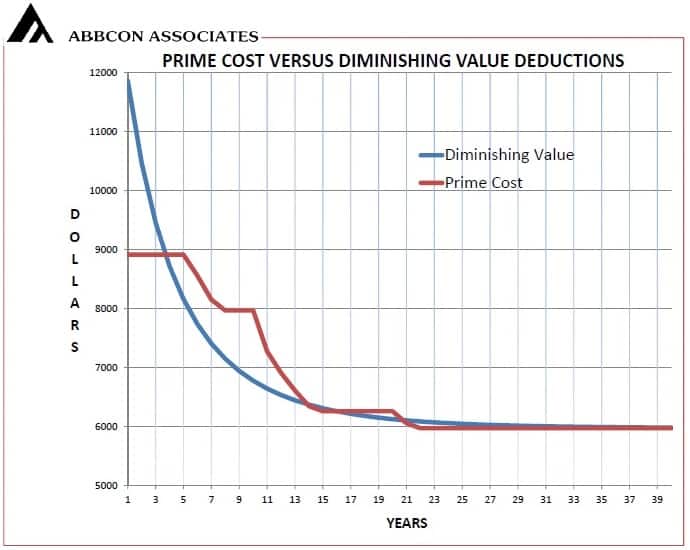

The above graph compares Prime Cost and Diminishing Value methods used in producing ATO compliant Tax Depreciation Schedules.

The graph shows the deductions claimable for each, in thousands over a period of 40 years. The above graph represents typical Depreciation deduction values for a residential unit or townhouse.

How Do I Choose a Particular Method?

The circumstances where you may consider using the Prime Cost instead of the Diminishing Value method are broadly as follows:

- You have resided in the property for say 7 years or more, before deciding to rent it out.

- You have been renting your investment property for 10 years or more and have not been claiming Tax Depreciation deductions.

- It may suite your personal financial circumstances to spread the allowable deductions evenly over the period that the property is being leased.

In the above circumstances it may well be beneficial to choose the Prime Cost Method for your Tax Depreciation Schedules. Your accountant or tax adviser can advise you on the method that best suits your personal circumstances.