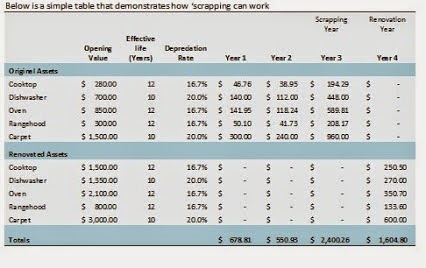

Renovation of existing buildings and disposing of depreciable assets also known as ‘scrapping’:

Scrapping is the removal and disposal of any depreciable assets from an investment property.

It can be defined as the demolition of any existing structure or fixture onsite that would have been eligible for claiming depreciation deductions.

Scrapping of existing structures, fixtures and fittings is an effective method of obtaining deductions within Australia’s tax system. It can provide additional tax deductions for property owners who demolish or dispose of existing buildings or part thereof so long as they were owned as an investment asset and eligible to produce income.

If an investor decides on ‘Scrapping’ an item, the amount that is yet to be written off for a particular asset (the residual value) can generally be claimed as a 100% tax deduction at the time of disposal.

In a newly purchased property, there must be an intention to rent the property as is. It is important to note that the ATO has been quite clear that purchasing an investment property with the intention to renovate it immediately, does not fit their criteria for being eligible for scrapping deductions. It must be currently an investment property under your ownership and available for lease for a period, which is not specified. If you then decide to renovate, you may then claim 100% of the residual asset value of items that are worn out or obsolete

For further information contact Abbcon Associates on 03 9873 7144 or email us at erik@abbcon.com

, we will be happy to give you an obligation free quote or answer any questions about your particular property

Leave A Comment